Banks feeling the pinch?

Purchase of residential property has historically been the leading loan by purpose in Malaysia. In this year first quarter, the trend remains the same. RM607,954 millions of the approved loan in commercial and Islamic banks was for residential property.

With the unprecedented pandemic, the number of loans currently on moratorium will be significantly from property purchase as well.

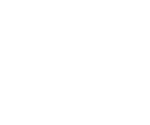

In comparison of Non-Performing Loan (NPLs) by Purpose, Working Capital has been the leading NPL Malaysia by percentage share.

However, NPLs from Residential property has showed an increase over the year with notable spike since second quarter of 2018. Previously the NPLs of Residential Property was averaged around 5000 mil since 2013. With the recent spike, the NPLs due to Residential property loan has mounted to 7500 million on the first quarter of 2020.

While being pushed by all angles on the extension of the moratorium, the banking industry appeared as the least vocal on the situation.

The decision to extend or not extend the moratorium will have negative repercussion on the banking institutes.

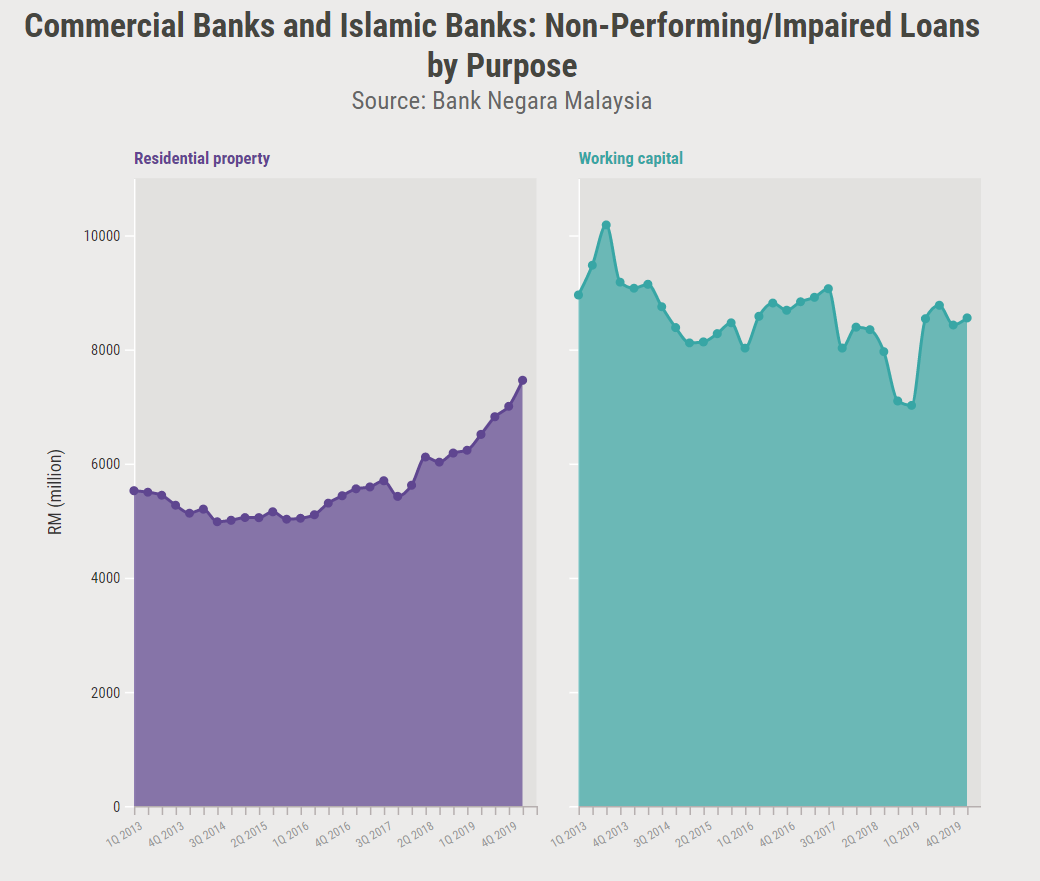

Should consumers remain ill-equipped to pay once they must start paying again, there will be predictably higher rate of Non-Performing Loans (NPL). NPLs are defined as loans overdue for more than 90 days.

Malaysia’s NPLs Ratio stood historically low at 1.6 % in May 2020, similar to the previous month. But Bank Negara Malaysia deputy governor, Jessica Chew stated that the NPLs is expected to rise as there will be businesses that will continue to face difficulties.

Besides that, while the moratorium does not really affect the profitability of a bank, it may impact their cashflow.

Malaysia Building Society Bhd (MBSB) reported a first-quarter net loss of RM73.25 million owing to higher provisions for potential loan losses. It is the first local banking group to report a quarterly loss since the Covid-19 onslaught.

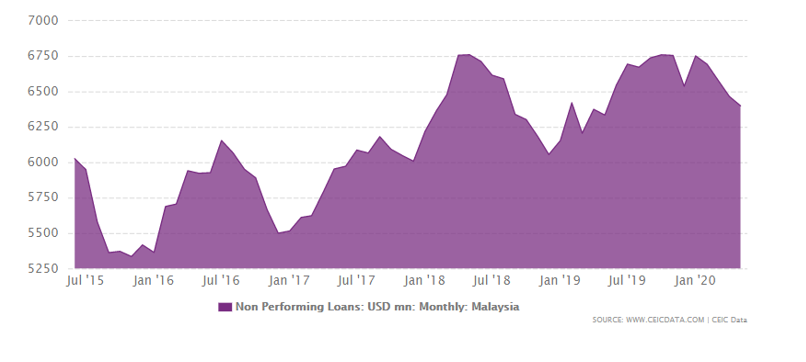

A loan loss provision is an expense set aside as an allowance for uncollected loans and loan payments to cover a number of factors associated with potential loan losses.

In 2017, Malaysia’s Loan Loss Provisions was reported at 2,018.800 million. This records a decrease from the previous number of 2,687.300 million ringgit for 2016.

However with the reported increase in MBSB, will other bank shared similar fate?