Initial Concern of Loan Moratorium

On the 27th of March 2020, the government of Malaysia announced PRIHATIN stimulus package to arrest the economic impact of Covid-19 pandemic and the Movement Control Order (MCO).

The stimulus package is worth RM250 billion and involved direct cash distribution to the family of B40 and M40. Private loan moratorium worth RM63 billion was also announced as part of the initiative.

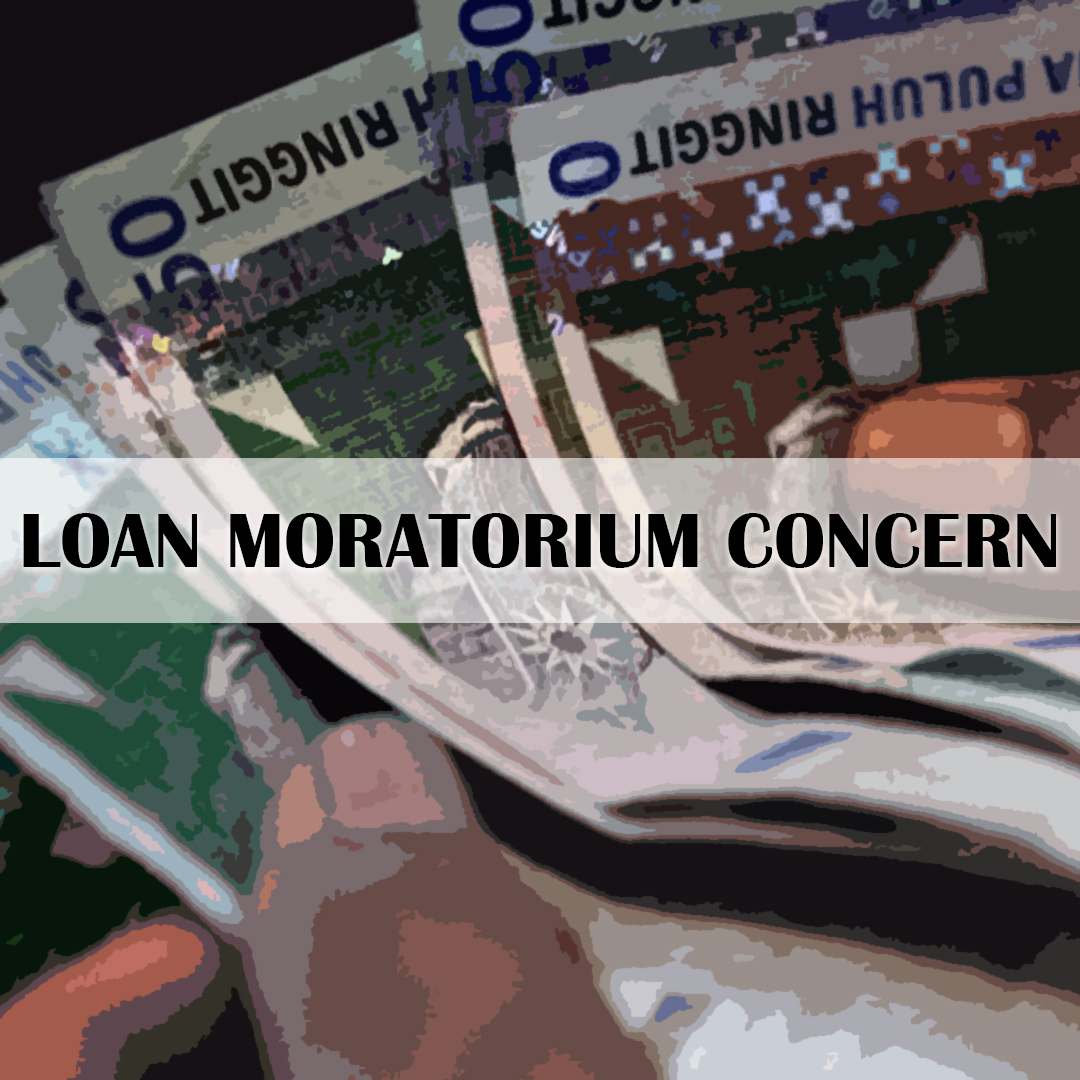

March recorded the highest media coverage on loan moratorium with 623 news following the announcement and the related Frequently Asked Questions (FAQs) that was provided to clarify the issue to consumers.

The news related to the loan moratorium has already made rounds in the media before PRIHATIN announcement. Its highest news exposure on the initiative is seen on March 25, two days before the formalization of the initiative through the stimulus package.

The media coverage was based on the Bank Negara Malaysia (BNM)’s directive circular to all commercial banks to grant an automatic six-month moratorium (deferment) of all loan/financing repayments effective from April 1.

Automatic moratorium on loan repayments was granted to SMEs and individuals as an additional measure taken by BNM to relieve the burden on businesses and households. The initiative was covered heavily since PRIHATIN announcement till April as informational clarifications are issued on the moratorium.

In May, the issue of compounded interests for hire purchase are making headline as many assumed that the moratorium also pertains to interest. After the issue was addressed through waiving the interest, the numbers of news have already subsided throughout mid-May till June before notable recent spike following the question on whether the loan moratorium will be extended or not.

Meanwhile, accrued interest or profit imposed by financial institutions on hire purchase customers was previously not exempted for the six-month moratorium period. But due to the poor clarification, many consumers misunderstood the initiative. BNM has since removed its FAQ dated 27 March while expressing regret over the confusion.

Following the notable backlash by the public on the issue, the Finance Minister reversed its previous stand. In the end, the banking industry had to bow to their clients’ demand and no additional interest is charged for hire purchase agreements during the 6-month deferment period.

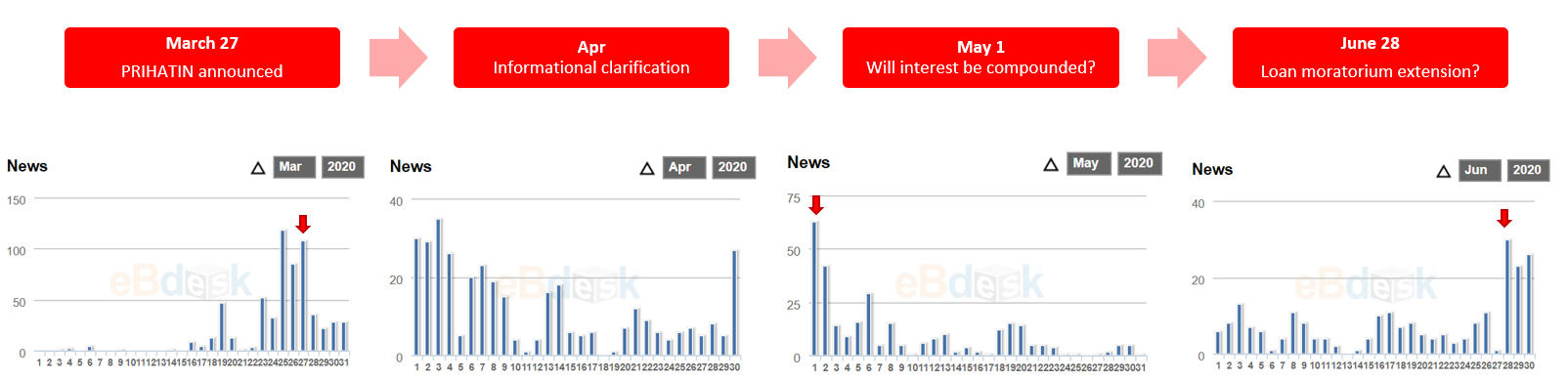

The interest during this timeframe was on the extension of the loan moratorium. Given the fact that the moratorium is going to end in September, the growing anxiety is already palpable among the people.

With the increasing unemployment rate and expected recession, consumers ability to pay back their loan has not yet stabilized. Based on a survey by Agensi Kaunseling & Pengurusan Kredit (AKPK), a financial consultation agency by BNM, a total of 88% respondents had sign up for the moratorium. The survey also recorded 35% increase of financial stress among working adult during the MCO.

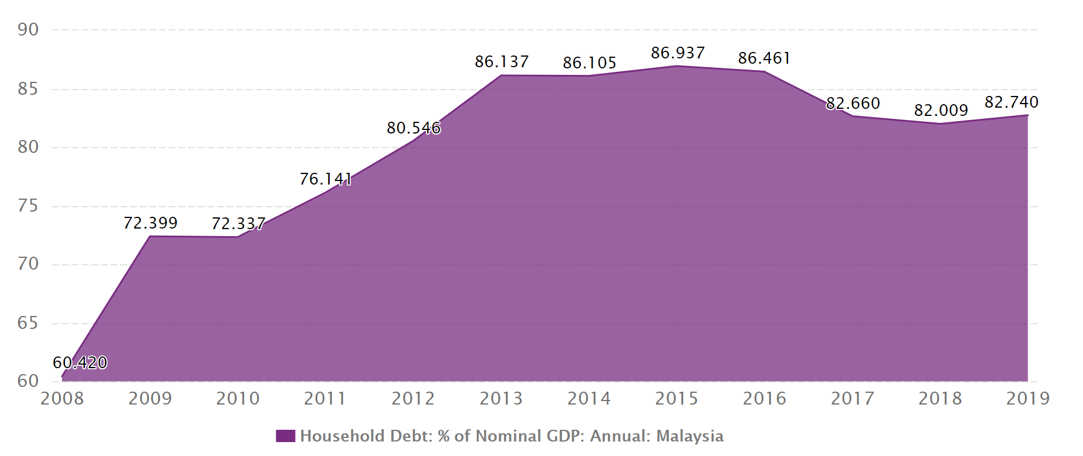

The increasing pressure is a reflection on the burden of debt on Malaysian household. In December 2019, household debt accounted for 82.7 % of the country’s Nominal GDP.

With the lack of disposable income, Malaysia household saving rate was also reported to be among the lowest in the world.