More than two-third of self-employed workers are not prepared for another financial crisis

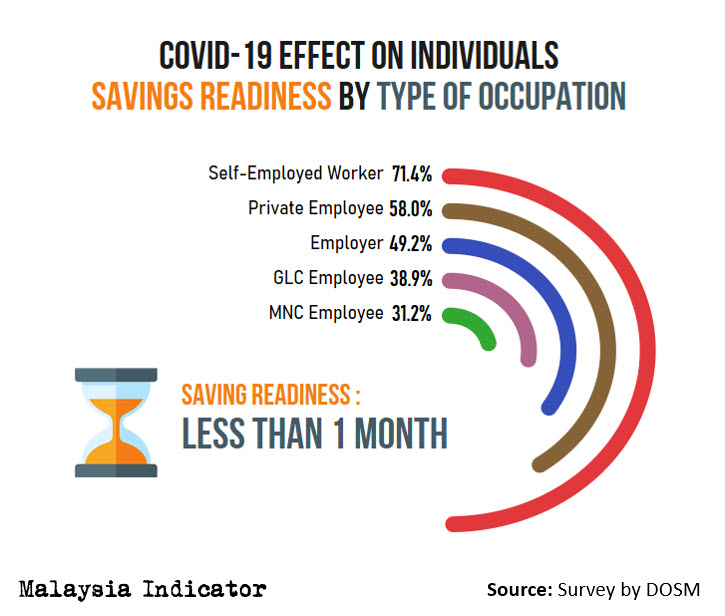

According to a survey conducted by the Department of Statistics Malaysia (DOSM), the agriculture sector was found out to be the most impacted industry during the Covid-19 pandemic.

21.9% or about one out of every five workers in the agriculture sector have lost their job because of the health crisis.

It was followed by the service sector and the industry sector with job lost percentage at 15% and 6.7% respectively.

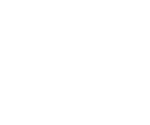

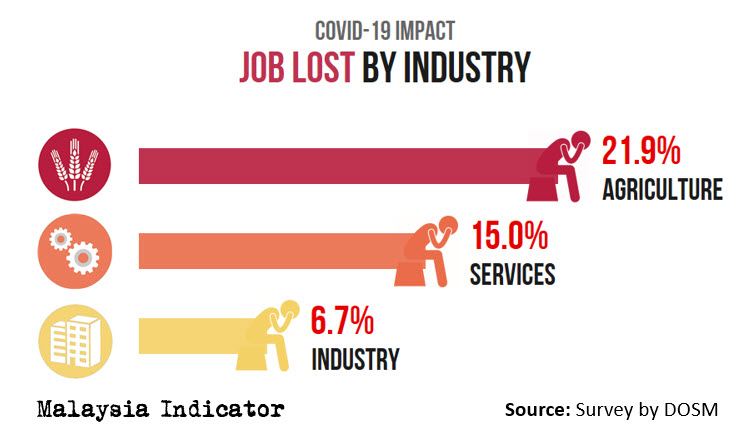

When it comes to the saving readiness by type of occupation, the ‘self-employed worker’ category was seen to be the least prepared.

71.4% which is more than two-third of the self-employed workers in Malaysia have less than one month of savings in their accounts.

Private employees (58%) and employers (49.2) were also at an alarming situation for not being financially prepared amidst the Covid-19 pandemic.

Employees working under multinational corporations (MNCs) were seen to be the most prepared. Yet, about one out of three employees in MNC have less than a month of savings to spend.

There is no doubt that businesses were affected with the ongoing movement control order (MCO). Hence, the economy activity in the country had slowed down. It led to poor sales performance and eventually people would lose their jobs.

Once the MCO is over, people would also be more cautious in their spending to improve their financial readiness, bracing for the potential upcoming global financial crisis. Consequently, businesses would have a decline in sales.

Ultimately, the economic activity in the country would remain on a declining trend. Therefore, an economic stimulus package is important to keep the economic activity ongoing during troubled times.