Sugar tax is effective from July 1

Sugar tax has been implemented in Malaysia from July 1. An excise tax of 40 sen will be imposed on carbonated or flavoured drinks, and any other non-alcoholic beverages with a sugar content of more than 5g per 100ml.

Meanwhile, fruit and vegetable-based beverages will only be imposed the 40 sen tax if it contains more than 12g of sugar per 100ml.

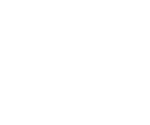

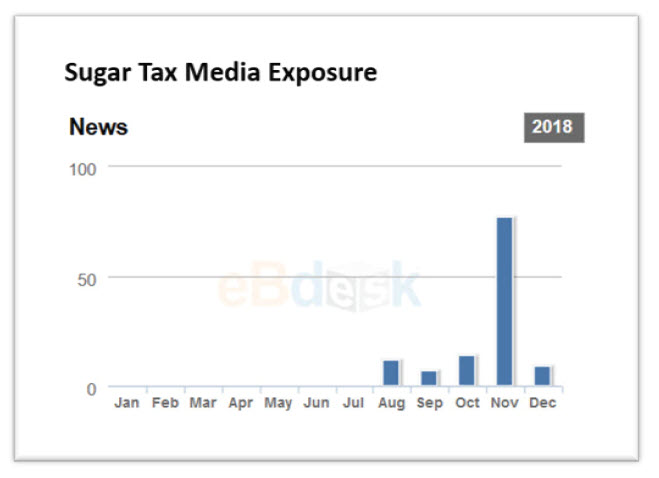

The idea of the sugar tax was first hinted by special officer to the Finance Minister Tony Pua in August 2018.

But it drew criticism as Pua said that the tax would not burden the low-income earners in the B40 group.

Drinking sugary drinks is not encouraged as it could lead to health problems, particularly diabetes, but Pua’s statement offended the people for implying that the B40 group could not afford to purchase a soda.

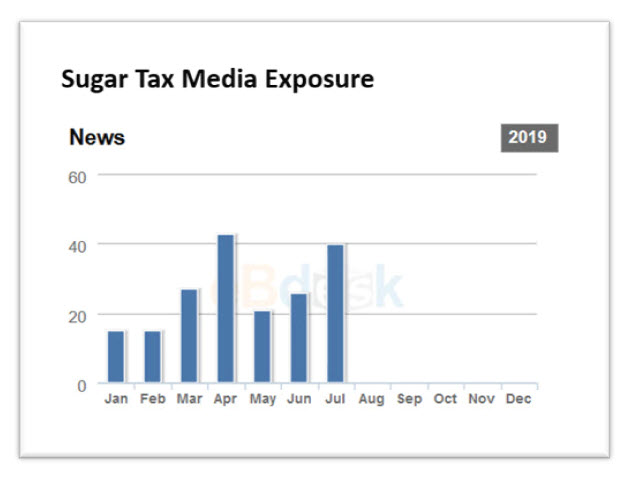

Regardless, the sugar tax was officially tabled in the 2019 Budget by Finance Minister Lim Guan Eng.

The excise tax was supposed to be implemented on April 1 but was delayed to this month after receiving feedback from the stakeholders.

Nevertheless, Malaysians would not be affected by the sugar tax instantly as there will be a two-month transition period for business owners to implement the tax.

Besides that, importers are granted postponement from submitting their lab reports from July 1 to August 31.

Therefore, Malaysians would probably feel the price hike in their favourite sugary beverages at the end of August.