Troubles in FGV

Listed in June 2012, FGV is arguably another entity that is comparable to 1MDB.

The second largest initial public offering (IPO) worldwide by the time of listing, FGV was popular in the local bourse. It had once hit the intraday high of RM4.84 per share which translates to RM19.846 billion of market capitalization.

Today, the share is trading at the level of RM1.15 per share, equivalent to RM4.26 billion. A total of RM15 billion had evaporated in the air.

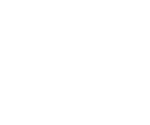

For one, it is easy to blame the global crude palm oil price.

When FGV was listed, crude palm oil (CPO) was at its all-time high, trading at more than RM3,000 per tonne and has been trading at sub 3,000 level then.

However, this was not the only factor.

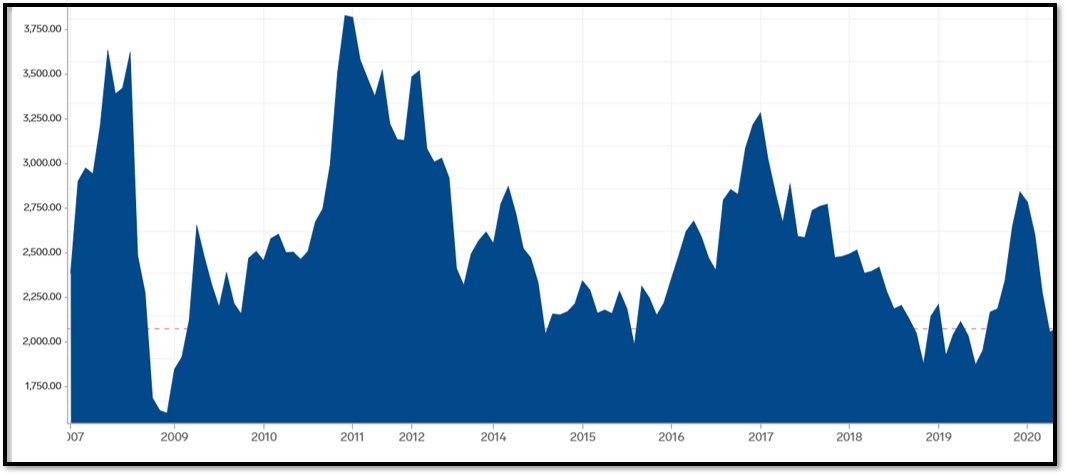

There are no other companies that made the same amount of wrong investment decisions as FGV did over a short period of time.

Most of the investment listed are deemed overpriced by analysts. Take the Asian Plantation deal as an example. The consultant, Deloitte, had opposed the deal. Although Asian Plantation owned 24,000 hectares land, 9,900 hectares were unplantable.

After the fall of Najib Razak on GE-14, at the end of Nov-2018, FGV sued 14 former directors and the senior management for losses suffered from their failure to discharge their respective fiduciary duty.

At the same time, FGV filed a suit against former chairman, Tan Sri Mohd Isa Samad and former CEO, Datuk Mohd Emir Mavani Abdullah over the acquisition of two luxury condominiums in Persiaran KLCC and is seeking RM7.68 million and other reliefs from both.

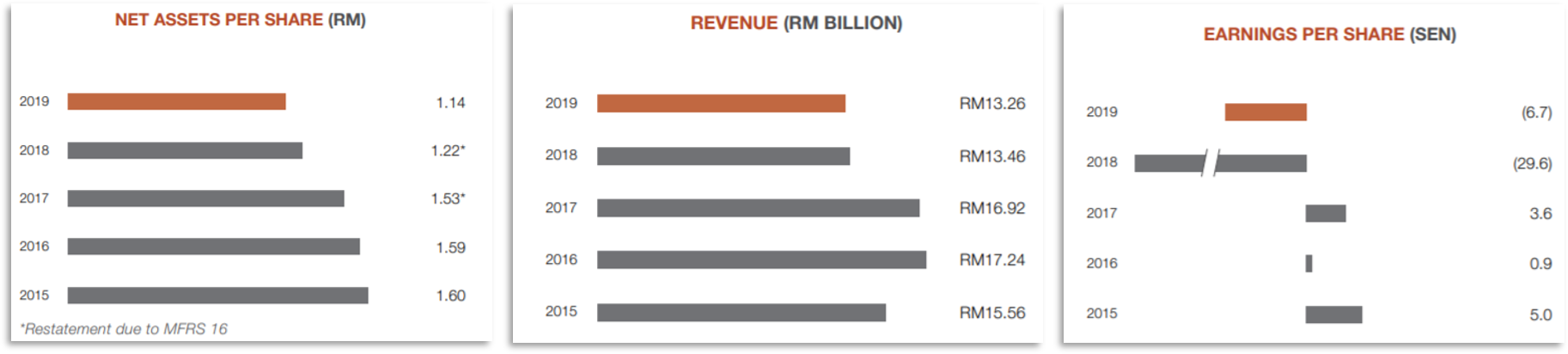

The effect of all these dubious deals were obvious.

The financial performance of FGV is in a bad shape recently.

With ever declining revenue, the company started making losses since 2018, and the net asset per share was deteriorating.

In the first quarter of 2020, the company again made loss of RM142 million, widening from RM3 million year-over-year.

During the quarter, FGV’s FFB production declined to 712,000 tonnes from 1.06 million tonnes in Q1 2019 – a 33 per cent drop. Total CPO production dropped 33 per cent to 514,000 tonnes from 762,000 tonnes in the previous corresponding quarter, as both yield and quality declined along FGV’s supply chain and within its own operations.

At the same time, the sugar sector recorded a loss before zakat and tax of RM28 million for the quarter in review.

Today, FGV is worth less than what it used to be compared to when it was listed – 75% of its valuation evaporated. With the scandalous mismanagement in the past, the company needs to go on a full image overhaul to regain confidence from the public as well as investors.

While internal economy and the current political situation would greatly affect the performance of the company, the external perception towards palm oil overall, would bring negative impact to the global demand.