Malaysia’s Semiconductor Exports: Growth, Geopolitics, and the Push for New Partnerships

Malaysia’s position in the global semiconductor industry is no accident—it is the result of decades of deliberate economic policy, industrial clustering, and strategic foreign investment. Today, Malaysia stands as a key export hub for semiconductors, contributing significantly to global supply chains through its strengths in assembly, testing, and packaging (ATP). But as the industry faces increasing geopolitical tensions, technological shifts, and competitive pressures, Malaysia finds itself at a crossroads: one that demands deeper international partnerships to sustain and scale its semiconductor export potential.

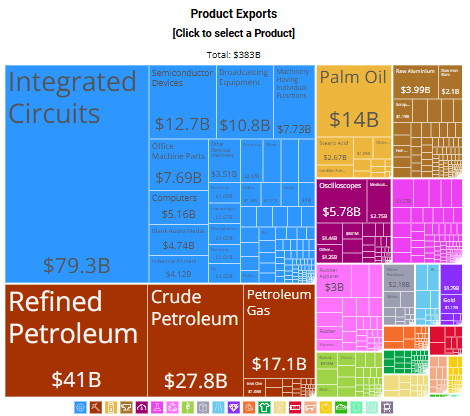

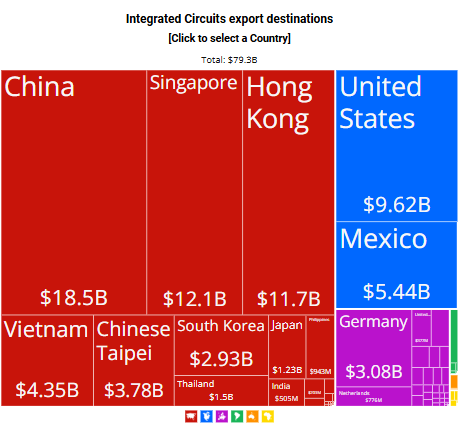

In 2023, the electrical and electronics (E&E) sector accounted for RM593 billion (USD 125.7 billion) in exports—35.4% of Malaysia’s total export value]. Within this massive figure, semiconductors (particularly integrated circuits) made up the largest share, reinforcing their role as the country’s top traded product. Export destinations include global tech heavyweights such as China, Singapore, the United States, Japan, and Germany, positioning Malaysia as a vital link in the global high-tech supply chain.

What makes Malaysia stand out is its specialization in the back-end of semiconductor manufacturing. Though not yet involved in chip design or advanced wafer fabrication, the country accounts for over 13% of global ATP services. This niche strength has made Malaysia a magnet for foreign direct investment (FDI), especially from companies looking to diversify away from concentrated markets like China and Taiwan.

This shift is already underway. In 2024, the Malaysian Investment Development Authority (MIDA) confirmed new investments from Texas Instruments, Bosch, and Lam Research. These firms are expanding their operations in Malaysia, citing factors such as skilled labor availability, strategic location, and trade connectivity through ASEAN, RCEP, and CPTPP agreements.

Looking ahead, Malaysia is actively seeking new partnerships to solidify and expand its semiconductor export base. The recently launched National Semiconductor Strategy (NSS) outlines key goals: enhance R&D capabilities, attract fabless design firms, build local talent, and support supply chain resilience. With these ambitions, Malaysia is not only strengthening ties with traditional partners like the U.S. and EU but also engaging with emerging semiconductor players like India, Vietnam, and Germany—nations that are investing heavily in electronics and digital infrastructure.

Another promising avenue is technology partnerships with fabless chip design companies, particularly in areas like AI, automotive chips, and Internet of Things (IoT). By inviting co-development or contract manufacturing arrangements, Malaysia could move beyond its ATP roots and climb higher up the value chain. Such collaborations could also benefit from knowledge transfers, increased innovation, and integration into global R&D networks.

Still, challenges persist. Talent shortages remain a bottleneck—Malaysia’s semiconductor sector requires an estimated 50,000 engineers, but the nation currently produces only about 5,000 engineering graduates per year. The government is addressing this through upskilling programs and TVET (Technical and Vocational Education and Training) reforms, yet private-sector engagement will be essential to scale efforts quickly.

In conclusion, Malaysia’s semiconductor exports are not only a source of national pride—they are also a strategic asset in an increasingly complex global tech race. By deepening existing partnerships and pursuing bold new alliances, Malaysia can secure its place as a trusted, innovative, and future-ready player in the semiconductor supply chain. The chips are down—but for Malaysia, they’re mostly going out.