All eyes on Digi-Axiata Merger

Following Digi and Axiata’s newsbreak of their merge, the two telco companies are put in the limelight once again.

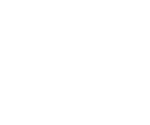

Both Digi and Axiata’s news exposure skyrocketed in April 8 when they suspended their trading activities on Bursa Malaysia ahead of their announcement.

Despite the shares of both telco companies surged the following day, the news exposure declined after the announcement was made.

Prior to their big announcement, their news exposure was low and was not consistent as there were almost no news on some days.

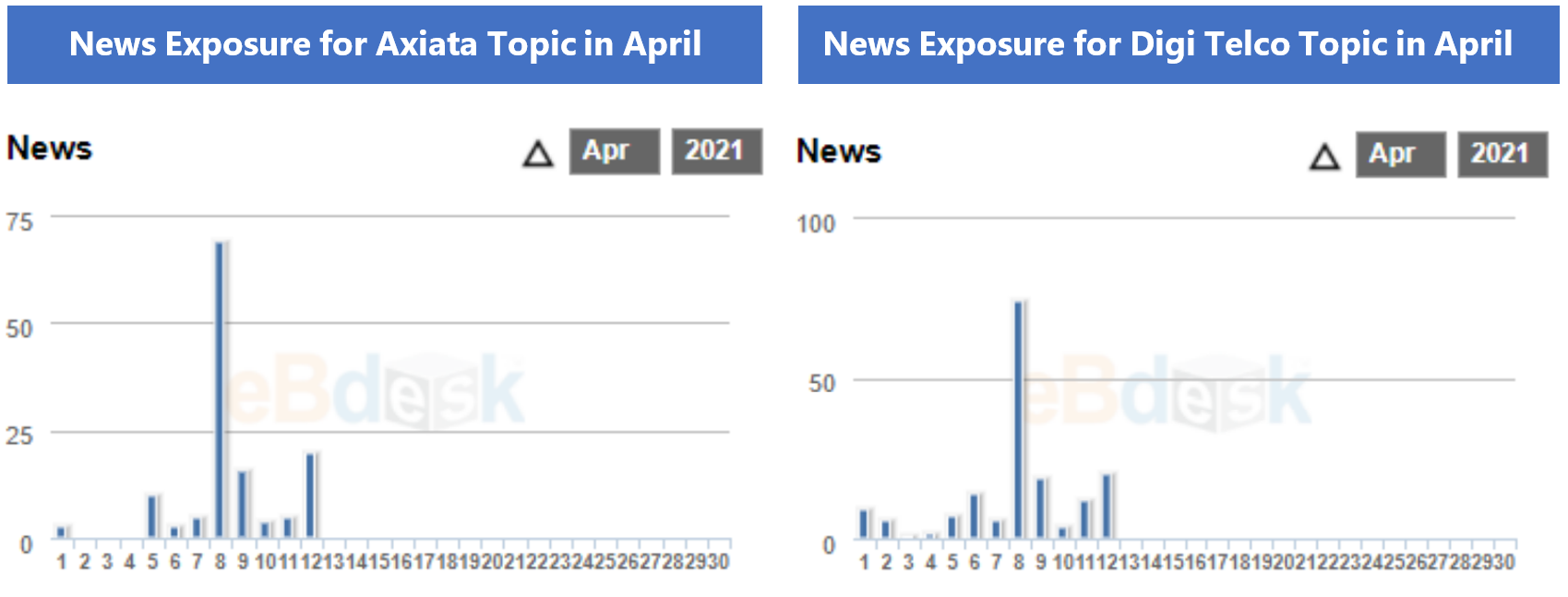

Looking the top issues for both companies, it seems that the media has been focusing on the merger during the week of the announcement on the recent merger.

Aside from that, the media is also focusing on the shareholder’s profits as KLCI snapped three consecutive days of gains due to profit taking.

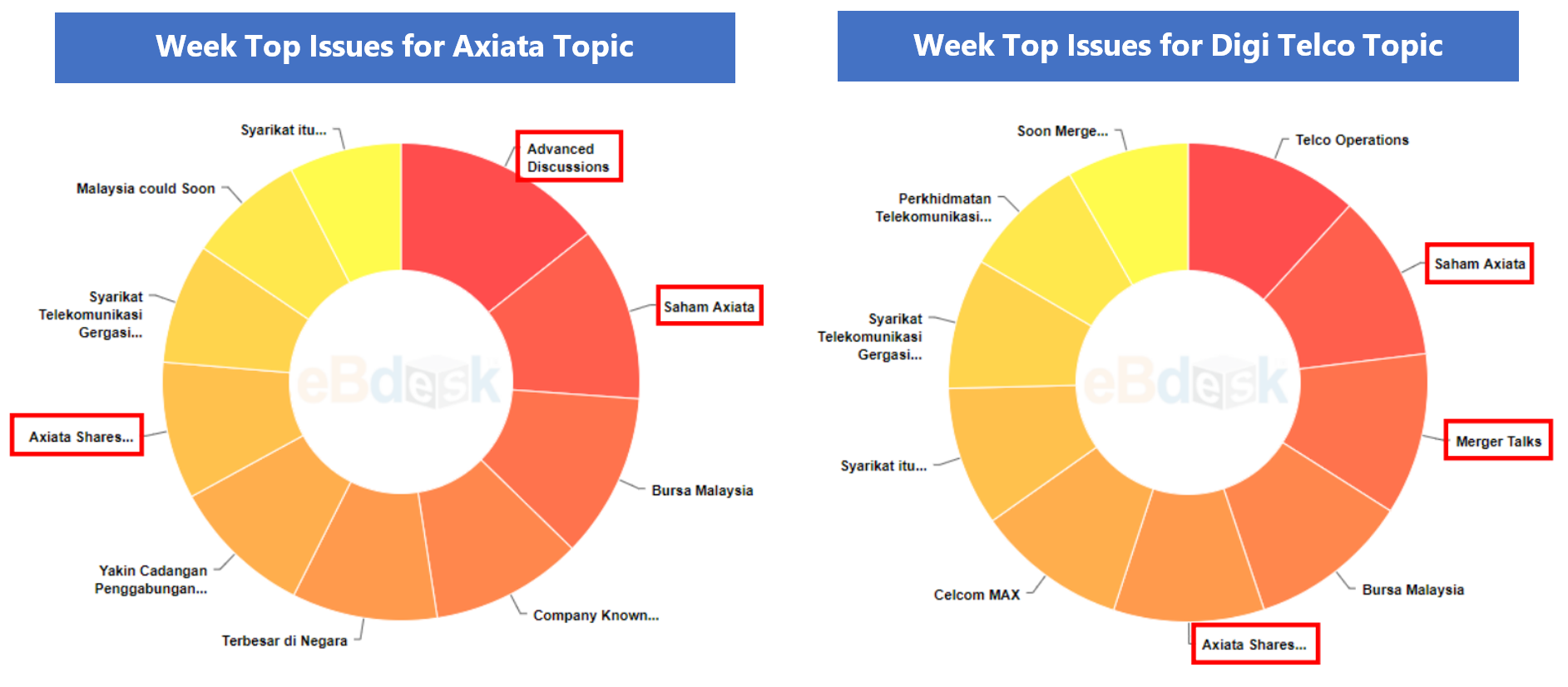

The insider trading for Digi shows that the news exposure of Digi has impacted their shares as the trend for news exposure mirrors the trading volume.

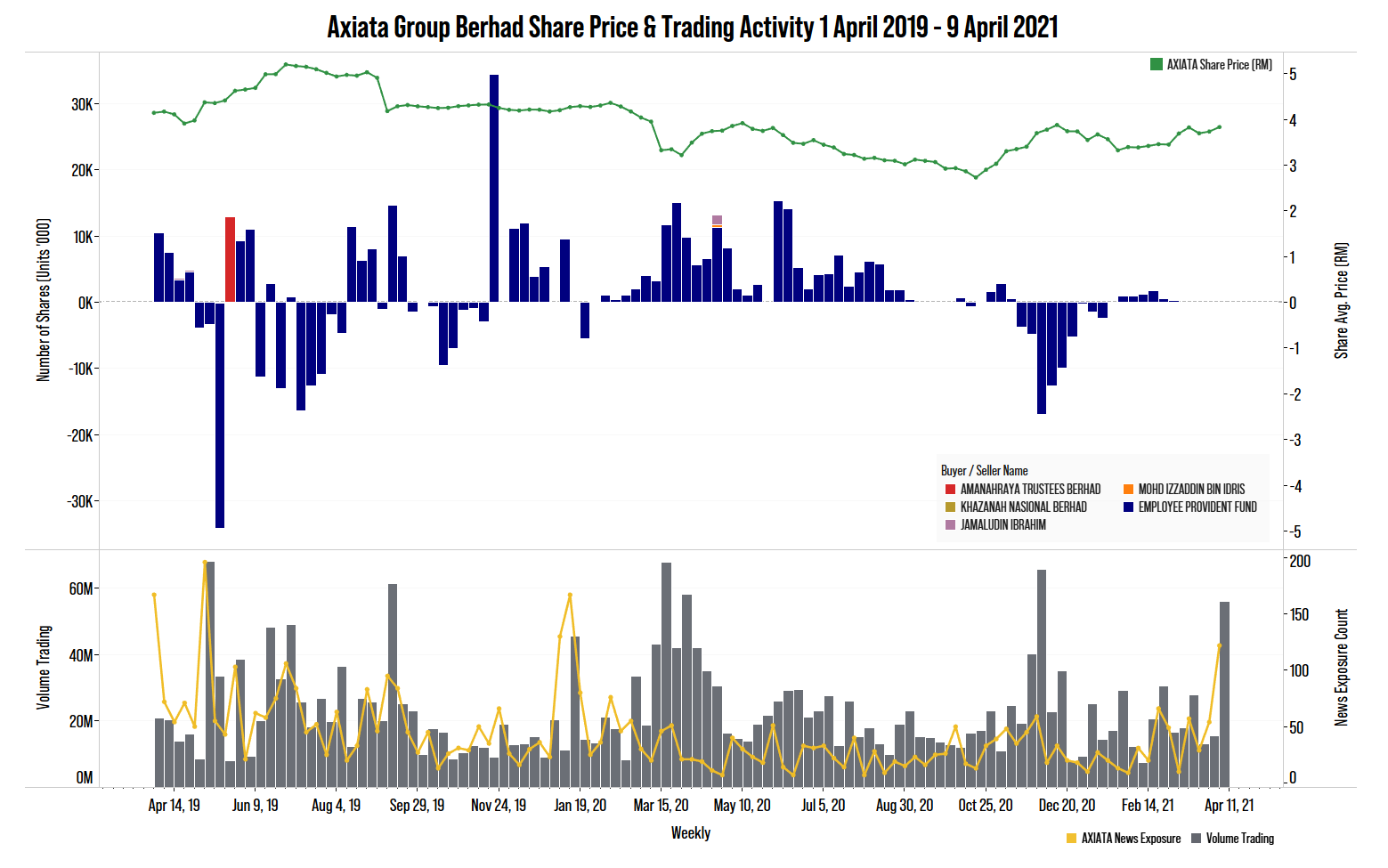

Meanwhile, Axiata’s news exposure is not related to the volume trading as compared to Digi. Nonetheless, both telco companies’ trading volume followed the news exposure trend after the recent announcement on their merger.

Previously, the two telco companies have attempted to merge back in 2019 but the consolidation was called off due to the rejection of the proposal by some authorities in the countries they operated in.