ANNJOO: Performance Recovered after MCO

Ann Joo Resources Bhd’s share price sour as performance has recovered during the third quarter of 2020 in terms of their revenue, net profit and net loss as compared to the third quarter of 2019.

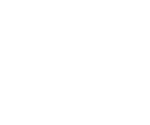

Looking at the graph, the company’s performance had plunged prior the Covid-19 pandemic where the net profit nosedived during the third quarter of 2019 which was probably due to the low demand for steel.

In the fourth quarter of 2019, the company’s performance had an improvement especially in terms of the net profit and their revenue.

However, after the widespread of Covid-19 infections and the implementation Movement Control Order (MCO), the net profit of the company dropped again during first quarter of September and second quarter of Jun 2020.

During third quarter of September 2020, the net profit of the company recovered after having a massive loss during the previous quarter.

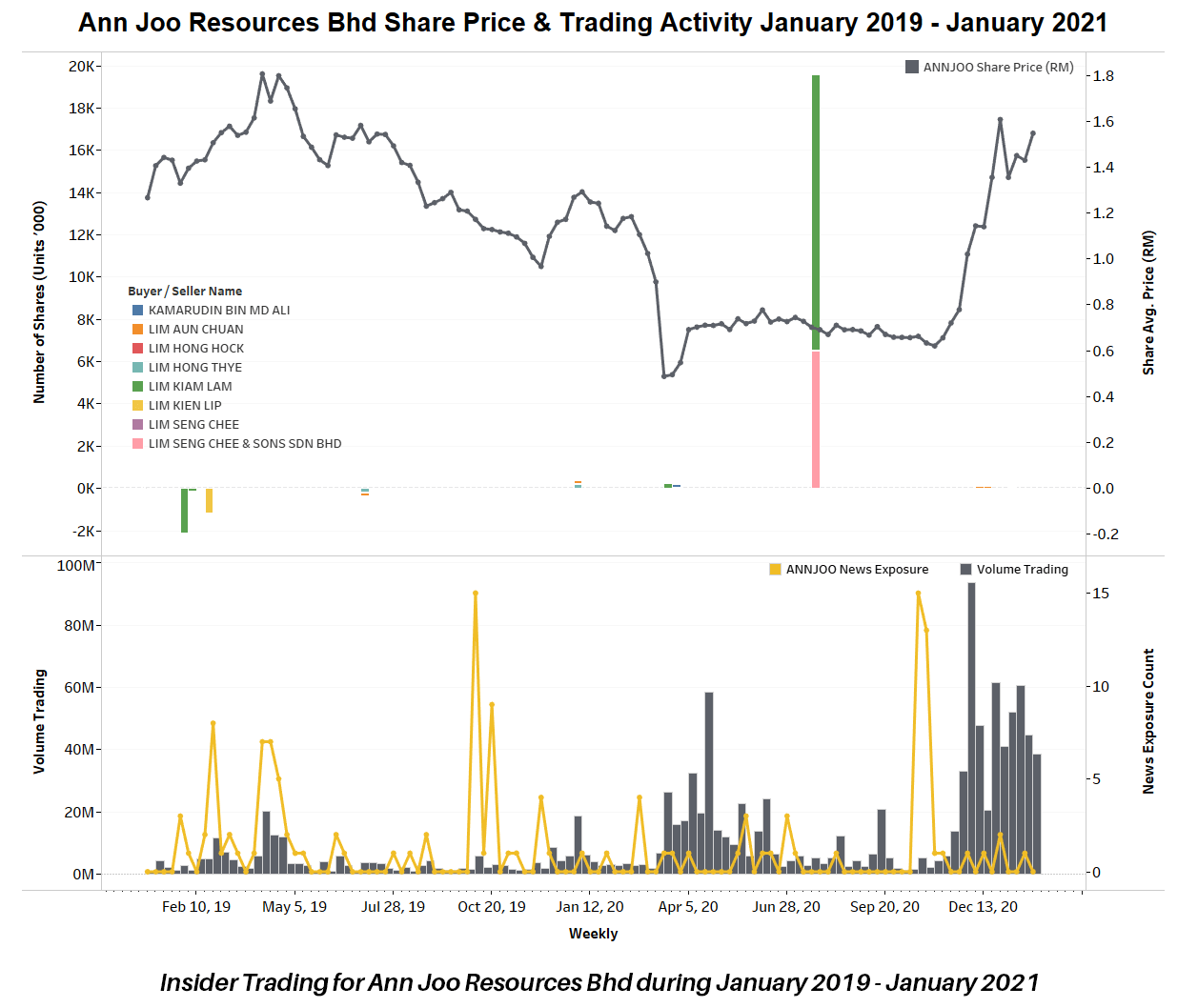

Meanwhile, the share price for ANNJOO started to increase on the 21st January 2021 gained from the government’s revised anti-dumping law on the 23rd of January 2021.

During the month of February, the price has gone up 13% from RM1.99 on 16th January 2021 to RM2.25 on the following day.

On April and December 2020, Ann Joo Resources Bhd’s trading volume and the news exposure did not compliment each other as the volume trading for both months especially in December is higher than the news exposure.

The major shareholder for the company is the Group Executive Chairman of the company itself, Lim Kiam Lam and Lim Seng Chee & Sons Sdn Bhd.

On a side note, the government has decided to implement the anti-dumping duties after investigations were made by the Ministry of International Trade and Industry (MITI) on the steel products which have been found to be imported into Malaysia at a lower price.

Thus, the government has decided to impose the anti-dumping duties on certain flat-rolled steel products imported from China, South Korea and Vietnam for five years.