The Impending Doom

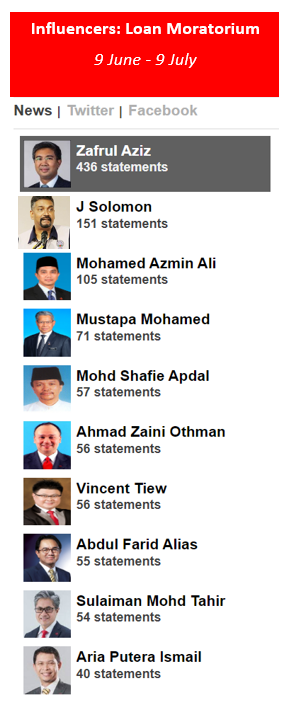

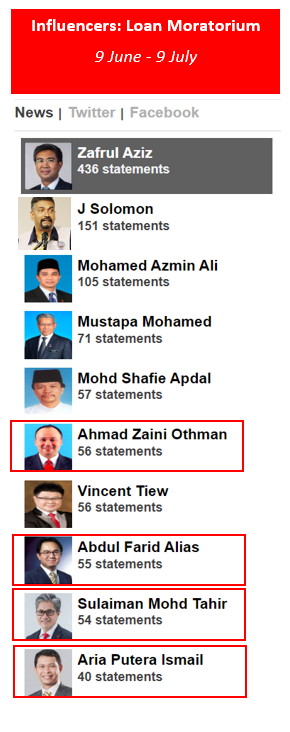

From 9 June to 9 July 2020, Zafrul Aziz as the Finance minister appeared as the leading figure in addressing the loan moratorium issues. In fact, most of the leading influencers over one-month period has been politicians with Azmin Ali and Mustapa Mohamed being visible.

The voices from the banking industry itself was not as visible.

J Solomon, the secretary-general of Malaysian Trades Union Congress (MTUC) was the second leading figure. As a vocal figure on employees’ rights, he continuously advocated for the benefits of employees and consumers. As such, the narrative on the loan moratorium has been largely dominated by the consumer side as politicians are even more inclined towards championing the public cause.

Finance Minister, Zafrul Aziz insisted that the banks have been given the authority to decide on extending their moratoriums and will not be forced to do so.

With the increasing pressure of consumer voice, he took the middle ground by highlighting targeted moratorium suggested to the banking industry instead of blanket approach. But following borrowers’ pleas for more time to recalibrate their finances, will the finance minister later impose moratorium extension on all banks?

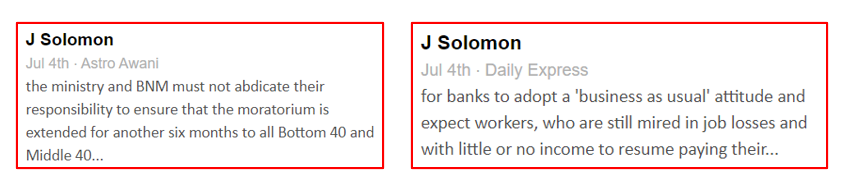

As a fierce employees’ advocate, J Solomon appeared to aggressively advocate for the moratorium extension. As the voice of Malaysian Trades Union Congress (MTUC), his statement adds up to the current public discourse.

Meanwhile, Azmin Ali’s media presence on the issue was mostly due to his media mention of the previous loan moratorium offered to the people.

The Minister of International Trade and Industry did not address the current pressure on the extension of loan moratorium but was quoted over his statements on the holistic approach taken by the government in addressing the pandemic and its economic repercussion.

Mustapa Mohamed on the other hand, directly addressed the issue. As the Minister in the Prime Minister’s Department (Economy), he is reassuring the public that their concern will be weight into the matter.

According to the Jeli MP, the extension of moratorium must be studied carefully especially if the economy is not gaining momentum after the MCO.

Other notable influencer that side with the consumer is Vincent Tiew, a property entrepreneur. The figure was quoted to support the extension of the loan moratorium for the property sector for another six months.

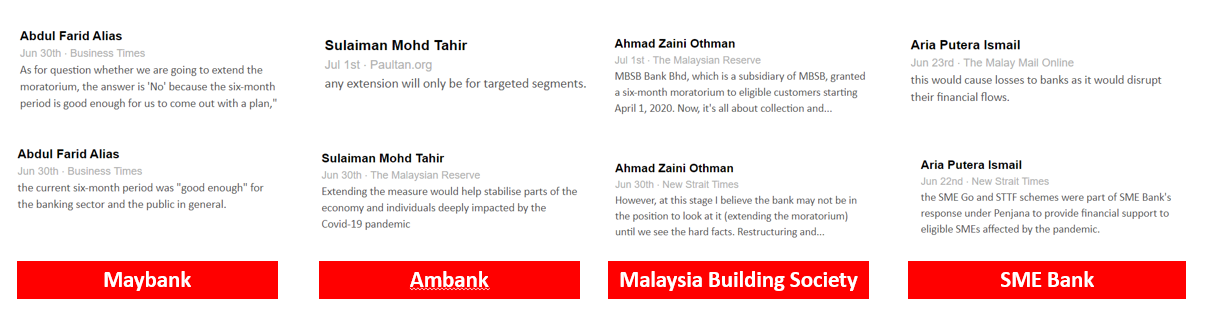

As for the counter narrative, the voices of the Banks dwarfed in comparison with other influencers. The CEO of Malaysia Building Society, Maybank, Ambank and SME Bank are among those in media presence.

The CEO of Maybank, Abdul Farid Alias stated that the bank does not favour extension of the moratorium while Ambank appeared to be more lenient by offering targeted extension. Ahmad Zaini Othman, CEO of Malaysia Building Society that owns MBSB Bank Bhd emphasize that the bank is geared up for the collection phase and is not looking to extend the loan moratorium. Similarly, SME Bank does not hint on an extension but emphasize on new financing support initiative to help SMEs.

Consequently, without the extension of the moratorium, personal bankruptcy is expected to increase. implying lower business in the future for the banks. The unemployment rate has spiked to 5.0 percent in April. With an estimated 800,000 workers losing their jobs until April this year, their inability to resume servicing car and housing loans may cause a spike on forfeitures of vehicles and homes.