28,374 Malaysians went bankrupt because of vehicle loans between 2011 and 2015

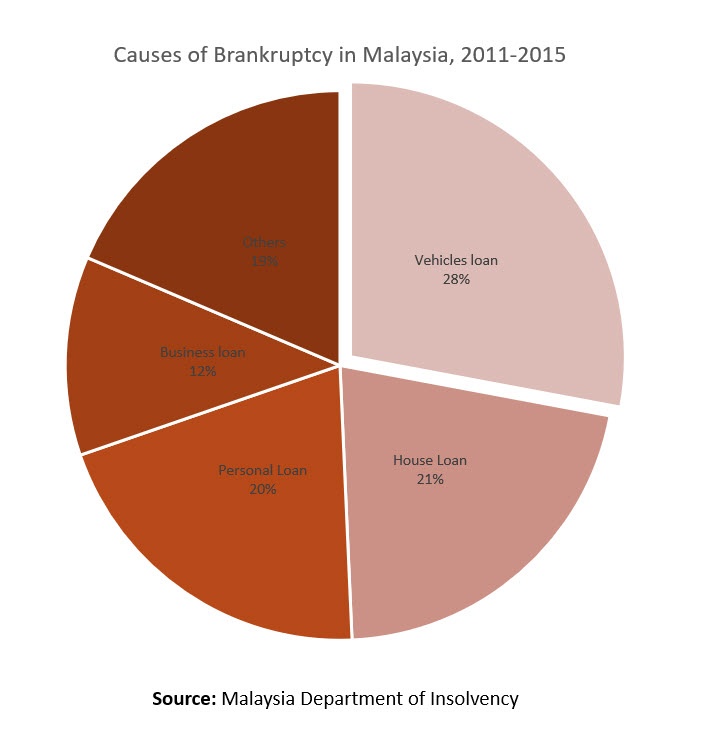

Did you know that Malaysia is one of the top 10 countries to have the highest vehicle per person ratio?

According to data from World Health Organisation’s Global Status Report on Road Safety 2015, Malaysia was ranked fifth with an average of 0.8 vehicles per person.

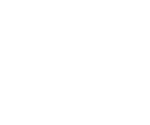

Meanwhile, the number one reason Malaysians went bankrupt was because of vehicle loans.

Based on statistics from the Malaysia Department of Insolvency, there were 28,374 bankruptcy cases (28%) caused by vehicle loans from 2011 to 2015. This took a toll on the vehicle sales in Malaysia.

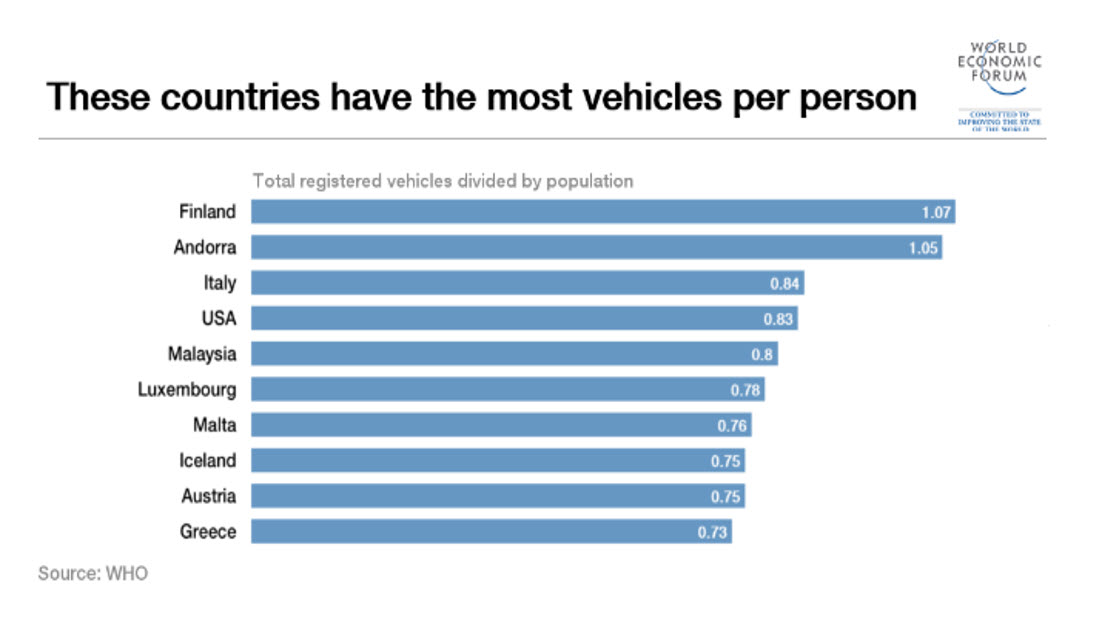

In the following years (2016 and 2017), there was a drastic decline in new passenger vehicles registered in Malaysia. But the trend did not last long as there was a slight increase in 2018.

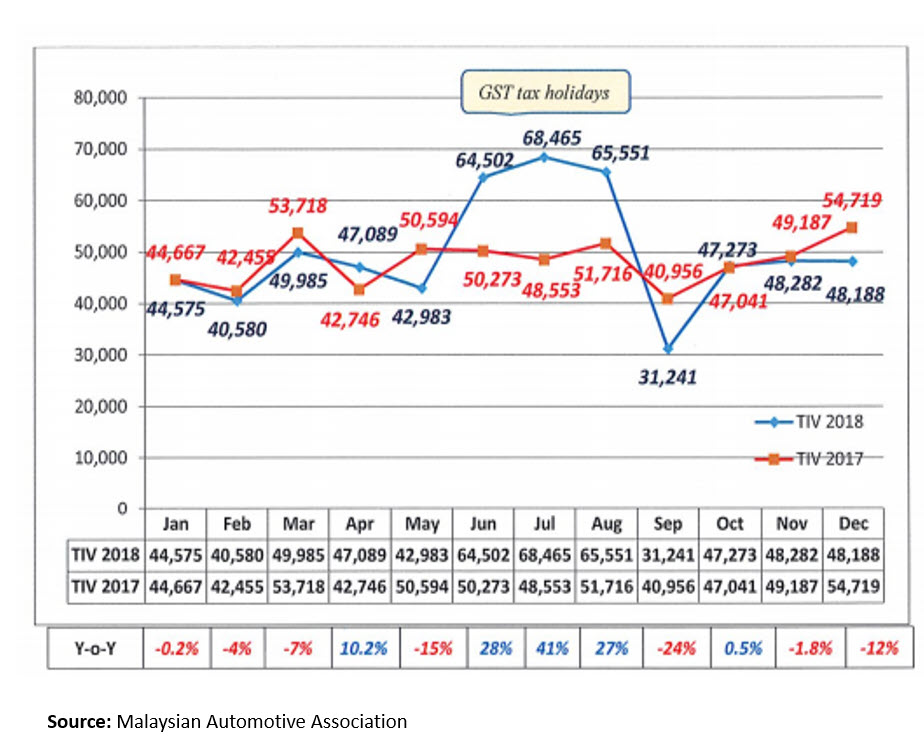

The increase was due to the tax holiday introduced in 2018, from June to August. During the tax holiday, vehicle prices were reduced by 6% because GST was zero-rated, and SST was yet to be reintroduced.

Malaysians utilized the tax holidays as more than 60,000 units of new passenger vehicles were sold each month of the 2018 tax holiday.

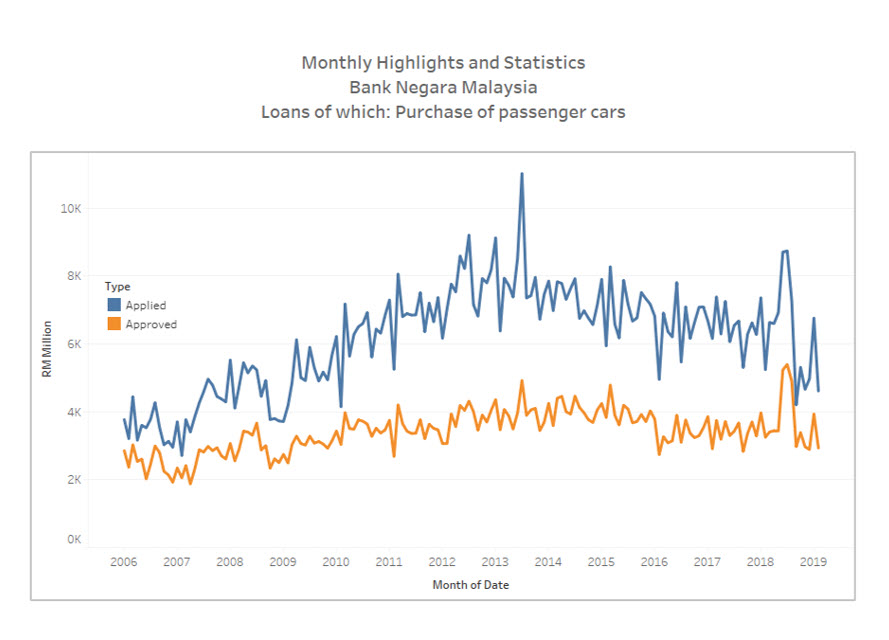

Additionally, there was a spike in loan applications and approvals for the purchase of passenger cars in mid-2018, coinciding with the tax holiday.

The high amount of rejected loans indicated that Malaysians were impulsive to purchase vehicles during the tax holiday even though they might not be able to repay their loans later.

What are the readers’ thoughts on this matter? Are Malaysians impulsive when it comes to purchasing vehicles?