Empowering Malaysia’s Informal Economy with PADU

According to the world economy, the informal economy in Malaysia represents 25.3 percent of Malaysia’s Gross Domestic Product (GDP), representing RM1,193.8 billion at GDP levels. Malaysia has the 6th largest informal economy as the percentage of GDP in the world, after Uzbekistan, Cyprus, Greece, Botswana, and Costa Rica.

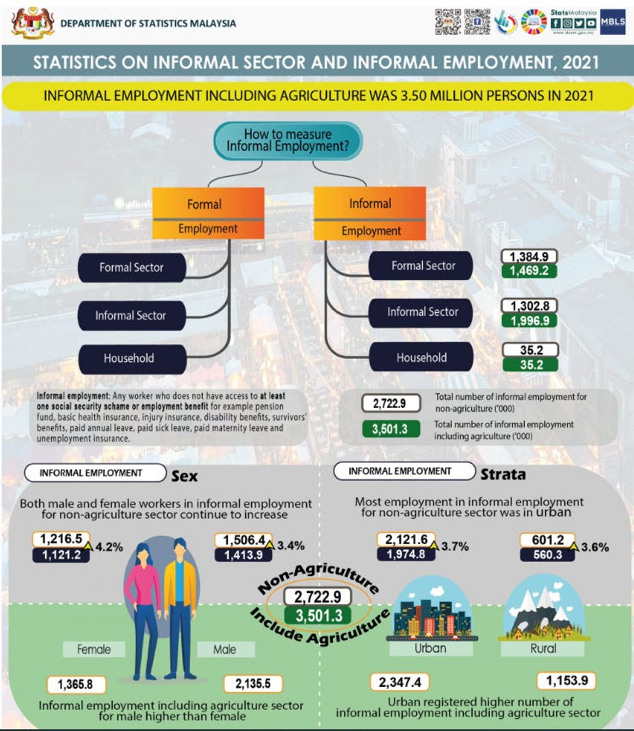

In 2021, the informal sector employment reached 3.5 million contributing 23.2 percent of the nation’s employment. The informal sector includes agricultural workers, construction site workers, auto and motor repairers, gardeners and grass cutters, home construction, babysitters, and childminders, food hawkers, content writers, general labourers, cleaners, tailors, seamsters, market sales people, food and beverage delivery riders, e-hailing drivers, lorry drivers, outsourced freelance workers such as internet salespeople, programmers, accounting, and bookkeepers.

According to the Department of Statistics (DOSM) about 5 percent have no formal education, while the majority are SPM (Sijil Pelajaran Malaysia) level qualifications holders. Median monthly income by those workers in the informal sector was RM2,062 per month, putting many families under the poverty line.

DOSM also stated that the poverty line for 2022 was defined as a monthly income of RM2,589 and below, while “hardcore poverty” was defined as the monthly income of RM1,198.

Though the informal sector is a major part of the Malaysian economy, it is rarely given the attention it deserves by policy makers, even though it contributes a lot. As was seen during the Covid-19 pandemic and MCOs, the informal sector is the most volatile sector of the Malaysian economy.

The informal economy is usually never seen as a driver of economic growth in terms of incentives and assistance due to the lack of attention. That’s why the informal sector holds down GDP per-capita to the levels that keep Malaysians in the middle-income trap.

Based on the International Monetary Fund (IMF) data, Informal sectors tend to remain small, with low productivity and limited access to finance. Also, they do not contribute to the tax base, depriving governments of resources to provide basic services to their populations. Second, informal workers are more likely to be poor and to earn lower wages compared to their peers in the formal sector. They lack social protection, access to credit and are generally less educated. Third, informality is related to gender inequality. Globally, 58 percent of employed women work in the informal sector, and are more likely to be in the most precarious and low-paid categories of informal employment.

In this sense, PADU will help to systemise these gig workers so they could be eligible to get the country’s benefit.

Early this year, the government established Pangkalan Data Utama (PADU), the central data hub that will contain all the Malaysian personal data related with family, education and also their finances. This will stop the system of eligibility, registration and application for social protection programmes intended for the informal sector, who cannot get access to formal financial services, such as bank accounts, loans, and insurance.

PADU’s verified and comprehensive datasets could create a bridge, allowing these workers entry into the formal financial landscape. The data in PADU would be verified by the government agencies which allows these gig workers to establish credible financial profiles, thereby enhancing their eligibility for services such as bank accounts and loans. The transformative impact spans various dimensions with newfound opportunities for accessing credit and financial services taking centre stage.

On top of that, PADU will help the government to tailor financial products that provide the specific needs and conditions of informal sector workers. With improved access to financial services, businesses operating informally can formalise their operations, enhance their creditworthiness, and participate more actively in the formal economy. It would not benefit individual workers only but also contributes to the economic development of the entire informal sector.

It is important to try and measure the size of the informal economy because of its significance, and also because it employs some of the world’s most vulnerable people. Informality can be measured in two different ways. The direct approach is based on surveys, voluntary replies, and other compliance methods to directly measure the number of informal workers and firms.

The only problem is to get the data verified. Even though formal workers could easily put their salary or income and bank loan verified by their company or financial services, these gig workers do not have all of that. Even though government stated that there will be specific agency pointed to verified them, but who and how they are going to do that?

By the end of the day, the government should prepare stronger policies to help these gig workers and encourage how PADU could help by putting them in the system. PADU also needs to follow with other policies such as the formalisation of business can encourage business owners to register their businesses with Companies Commission of Malaysia and provide legal protection for workers. This would improve job security and social protection.

The government should also provide free skills development programmes for informal workers to enhance their employability, income potential, and implement tax reforms. So that an efficient taxation system can be achieved to reduce tax evasion and generate resources for social programmes.