PADU: Illuminating Solutions for Malaysia’s Cost of Living Challenges

Malaysians have been feeling the pinch from the rising prices of goods, and now coupled with the weakening ringgit, many are facing more challenges in managing their daily cost of living.

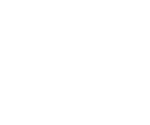

The Department of Statistics Malaysia (DOSM) stated that Malaysia’s inflation rate continued to increase at a slower rate, falling to 1.5 percent in November 2023 with the index points recorded at 130.9 against 129.0 in the same month of the previous year, Malaysia’s Consumer Price Index (CPI) edged lower to 1.8 percent in October, from 1.9 percent in September.

However, this does not seem to be reflected in the reality on the ground as prices of many goods still appear to be higher than what they used to be.

Source: Data DOSM

Malaysians are struggling with a confluence of economic woes that are pinching their wallets and impacting daily life.

To understand why this is happening, we first must understand what CPI is.

The CPI is one of the ways of measuring inflation. Measures by monthly change in prices paid by consumers, based on a representative “basket of goods and services”.

Among factors that could affect the CPI include raw materials cost, commodities prices and supply disruptions. While cost of living refers to the amount of household spending, including financial obligations such as car and housing loans, to maintain a certain standard of living.

The CPI tracks price changes for a fixed basket of goods and services that represents the average spending pattern among households. As the spending of each household is different, prices of items can vary across locations. The CPI does not reflect the individual cost of living; instead, it is a more useful indicator for macroeconomic policies, which target the broader economy.

Economic analysts have said that one of the reasons that could contribute to a rising cost of living include the weakening ringgit.

In October, the Malaysian ringgit fell to its lowest level since 1997-1998. Asian financial crisis, with the currency weighed by the US dollar rise and widening rate differential with the United States. The currency dropped by 0.3 percent which is 4.7607 per US dollar, the weakest since 1998. Malaysian ringgit is the worst performer in Asia for 2023 after yen, having dropped by more than 8 percent against the greenback.

Not only that, the Malaysian ringgit has weakened more than 5 percent versus the Singapore dollar, its slide limited by the Singapore currency’s own weakening.

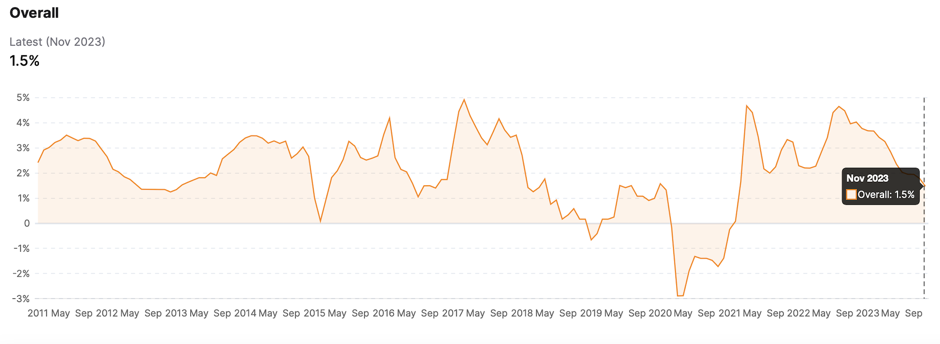

Malaysia relies heavily on imports for many goods, with the country’s food imports totalling RM 482.8 billion for the last 10 years, as of December 2022.

After his appointment, Prime Minister Anwar Ibrahim said his primary focus would be on the cost of living as he took office with a slowing economy and the country split deeply after a close election.

In October, Anwar stated that the National Action Council on Cost of Living (NACCOL) decided to continue intervention programmes through the Payung Rahmah initiative and Agro Madani Sales notwithstanding easing inflation in the country. The government also instructed the Federal Agricultural Marketing Authority (Fama) and the Farmers’ Organisation Committee (LPP) to be more proactive in acting as distributors of local white rice, especially for rural areas where people in such areas have difficulties in obtaining rice.

The government then decided to end the chicken price controls and subsidies as a measure to reduce leakages enjoyed by foreigners and high-income earners. The government stated that the termination actually supports the sustainability of the local chicken production industry and allows them to increase various socio-economic initiatives and people’s welfare including cash assistance.

Anwar also stated that Budget 2024 is a manifestation of the government’s continued commitment to reduce the cost of living, increase job opportunities and be more competitive. The total allocations amount to RM 393.8 billion, the highest budget ever presented. The budget outlined three main focuses which are Best Governance for Service Agility, Restructuring the Economy to Accelerate Growth and Improve People’s Living Standards.

He said that Budget 2024 witnessed an increase in the country’s revenue, following economic and fiscal restructuring, as well as the implementation of taxation reforms and targeted subsidies, which would be the best utilised to raise the standard of living of the people.

Continuing the effort, the government released its Progressive Wage White Paper in November last year proposing to implement the pilot project between June and September that involves the selected number of companies that participate voluntarily in it, with full implementation to be determined later.

In the first year of implementation, a progressive wage system to involve those earning monthly salary of between RM1,500 and RM4,999, covering some four million workers in formal sectors, will be limited only to Malaysian citizens.

The progressive wage will improve the quality of life and boost the productivity of low-income workers. It would narrow the income gap, entice more locals into the workforce and propel Malaysia into the ranks of high-income nations. Conjointly, it relieves the government of the obligation to inflate subsidies and welfare assistance to this worker-group. However, this might have unintended effects. For one, it would crimp company profits which might encourage companies to automate or lay off young and low-skilled workers.

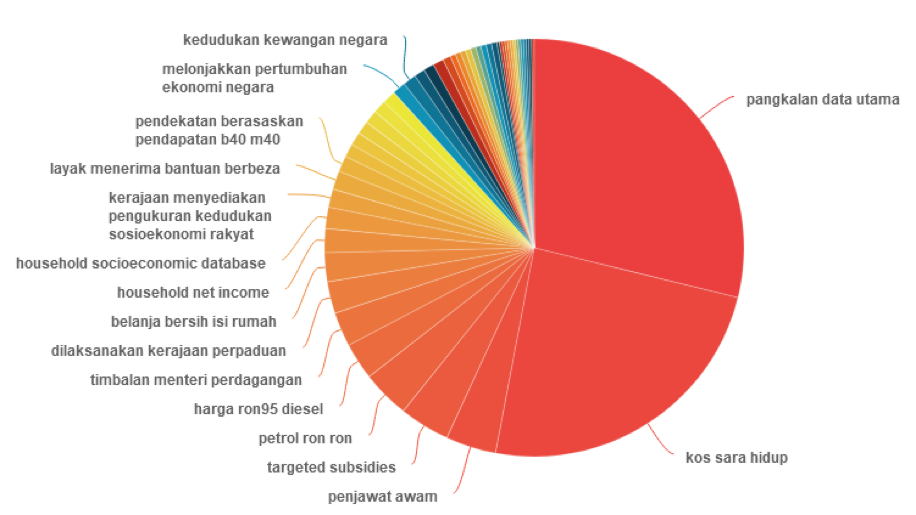

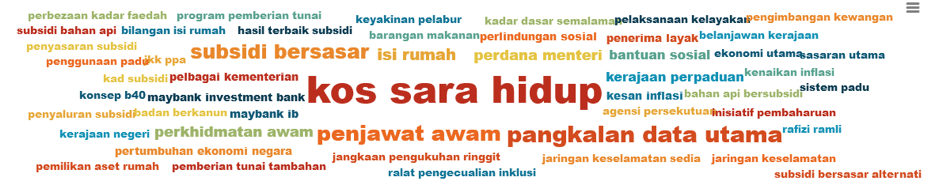

A progressive wage is moral but complex in implementation. Finding the delicate balance between fair compensation for workers and maintaining a sustainable business is a challenge. This may be seen as a long term needed solution, and it is not easy to change the business sector. The government came up with another plan, PADU or Pangkalan Data Utama.

PADU expected to help the government to ease cost of living issue. Its implementation will help the government provide a more accurate measurement of the socioeconomic position of the people and avoid omissions based on net disposable income.

Economic Minister, Rafizi Ramli elaborated that this measurement method considers the number of dependents and household size, cost of living relative to location. The distance to the workplace and ownership of assets like homes, vehicles and land.

“This approach would enable the government to depart from the conventional bottom 40% income group (B40), middle 40% income group (M40) and top 20% income group (T20) classifications, opting instead for a more targeted assistance approach based on well-defined criteria,” he said in his speech during PADU inauguration on January 2nd, 2024.

PADU is expected to become a step forward in reducing the gap between the country’s operating expenditures and development expenditure. Since then, the government has been spending a lot on operating expenditures, instead of focusing on the country’s development. As it is a well-known fact that previous subsidies were once misdirected. He added that now is the time to ensure that the aid goes to eligible recipients, emphasising that Malaysians are among the highest recipients of subsidies globally.

But the government needed to look deeply into the mechanism of how it would distribute assistance to Malaysians accurately and how it would solve cost of living issue. Since the cost of living between different localities, urban and rural areas are different.

As well as the living conditions also may vary, as a single person, as a family of four, or as a single supporting his family back in the village.

Nevertheless, the implementation of the PADU marks a significant step towards a more equitable socio-economic future for Malaysians. Moving beyond income brackets like B40, M40, and T20, PADU promises a data-driven approach to target subsidies and aid based on in-depth household expenditures, responsibilities, and location-specific living costs.

In addition to determining more precise target groups in distributing subsidies, PADU also becomes a platform to drive planning and policy management to empower the people. Even though the risk of data breach and how to implement the subsidy are still a question mark, PADU is expected to become the government’s tool to provide a more affordable cost of living to its people.