Global Strategies: A Comparative Analysis of Targeted Subsidies

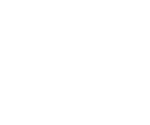

Starting 2024, Malaysia will slowly move from traditional blanket subsidies to a more targeted approach in providing assistance to its people. This move was made after the government budget flew to the roof with RM 303 Billion, the largest in the nation’s history.

In 2022, Malaysia spent RM67.4 billion on subsidies and social assistance, RM40 billion more than in 2021. Meanwhile, in 2023, the allocation was RM58.6 billion for subsidies and social assistance under the first unity government budget, an increase by 40% from the initial budget.

Unlike the previous one-size-fits-all model, targeted subsidies are specifically tailored to individuals or households meeting predetermined criteria based on their needs and circumstances. With this, the government expects to save around RM20 Billion per year from a shift to targeted subsidy system in a bid to narrow its fiscal deficit.

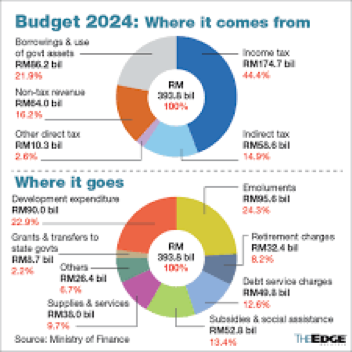

Most of the subsidies are fuel, electricity, cooking oil, education up until children car seats. While other countries focus on the importance of subsidies.

Earlier this year, the Natural Resources, Environment and Climate Change Ministry announced that the top 1% of electricity users in the country will pay a higher tariff between July and December 2023. This will affect 83,000 consumers who will face a minimum monthly increase of RM187 (+25%) in electricity bills. The move is to lift part of the subsidy for the highest 10% of electricity consumption and at the same time maintain the same subsidy for 90% of consumers. As it is, 10% of consumers with the highest electricity consumption enjoyed 50% of the subsidy, while 50% of the consumers with the lowest electricity consumption enjoyed only 10% of the subsidies provided.

The government also reiterated its intention to rationalise diesel prices in phases to prevent leakages. The price of subsidised diesel will, nonetheless, continue to be enjoyed by selected segments such as freight transport. In the second half of 2024, The government will start to roll out the targeted RON95 subsidy measures.

Continued in November, subsidies and price controls for chicken discontinued while subsidies and price controls for chicken eggs remain unaffected. The government concludes that chicken subsidies termination overlook the current supply and price trends, and the cost of chicken production has begun to stabilise, contributing to the current market prices being below the ceiling price.

While the cut in subsidies and consequently, higher prices pose challenges for households. The bottom 40% of households have a higher marginal propensity to consume and spend relatively more on food (35% of monthly consumption expenditure) as opposed to the middle 40% of the income group (30%) and T20 households (23%).

Thus, if price pressures are driven by food items, cost of living pressures are disproportionately experienced by lower-income households. The pandemic has brought weak income growth and the gig economy. This means in the face of marked price increases, some households would face greater difficulty sustaining their consumption.

As for now, many low income households enjoyed the benefit of subsidies, but with the government change of directory, most likely they are the most affected. Economic Minister, Rafizi Ramli also reiterated the government’s commitment to continue with its unpopular painful reform in the next two to three years, moving away from cash handouts and added that “sequencing” of the whole reforms is important.

That is why the Government came out with PADU or Pangkalan Data Utama as the central repository of individual and household data. This data hub will enable the government to come up with a transformative approach, underpinned by precision and tailored assistance for subsidies. With PADU, each subsidy would be customised with the established eligibility criteria, considering factors such as income level, disability status, household size, location, and dependency on specific goods or services. This meticulous calibration is designed to ensure that financial support is directed only for those who are facing genuine economic challenges.

The overarching goal is to maintain an inclusive and equitable social protection system that shields the rakyat from the burdens of rising living costs. Last year’s budget, a total of RM 63.8 billion, approximately 3% of the country’s GDP was allocated for subsidies and social assistance. Almost 60% of the total allocation will be utilised for broad-based fuel and electric subsidies while the remaining meant for social assistance mainly in the form of Rahmad Cash Aid (STR) as well as assistance programmes for welfare and education.

On top of the existing social assistance, the government had fortified the intention to implement a targeted social assistance programme to the vulnerable group. One of the Madani government’s aimed to reduce the cost of living which has increased gradually. So subsidy is still the best way to help the people but it needs a road map for the development and implementation of more targeted, comprehensive and sustainable social assistance policy.

Research stated that Malaysia’s social assistance programme has demonstrated several gaps due to the fragmented nature of social assistance programmes across ministries and agencies causing both inclusion and exclusion errors.

The high budget and uncertain world economy situation, Malaysia needs to transition from narrowly-targeted and stigmatising approaches to a more comprehensive developmental programme. In other words, instead of explicitly targeting poverty, focus will be given on addressing underlying vulnerabilities. Moreover, the government needs to include introducing an overarching act to oversee social protection as a whole for social assistance, social insurance and labour market intervention. This act will be very crucial for future targeted subsidies, without it, the government’s social ‘charity’ program continues to remain ambiguous and thus impacting effective implementation, including cash transfer programmes.

Before being able to save some budget, the government should create a subsidy policy. Malaysia is not the only country that uses this approach, neighbouring countries like Thailand adopt a more diverse subsidy framework, extending support across various sectors. On the other hand, Singapore leans towards a targeted and selective approach, aligning subsidies with specific policy objectives.

Targeted subsidy is needed and important to guarantee unwasteful consumption, remove leakage as well as to reduce the government budget. Malaysia needs to take this first step while continuing to ensure people welfare through the subsidy. PADU is one of the solutions. The government is confident with the central data hub, they can get all the people’s data and could determine the best subsidies for the needy.