High-Rise Property Impacted by Pandemic

The COVID 19 outbreak has created a slew of new hurdles for enterprises. In the short to medium term, the high-rise property market, like any other industry, will be affected. The impact of the Covid-19 pandemic may be seen in the real estate market, as high-rise property listings are in downward trends from pre-lockdown level.

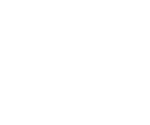

The decreasing trend of high-rise properties could be seen when comparing the number of high-rise properties listing during pre-lockdown or before the Covid-19 outbreak on 1Q2020 with 1Q2021 on a prominent property transaction platform.

The impact of Covid-19 was shown significantly in 1Q2021 when the number of high-rise properties in Malaysia fell to less than 2000 compared to 1Q2020 when the high-rise properties amounted to more than 3000.

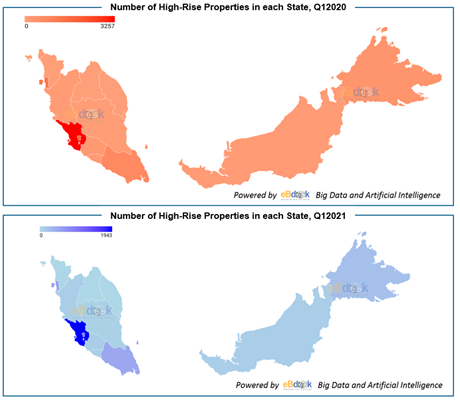

As the number of listings of high-rise properties dropped in 1Q2021, the number of transactions during the period has also fallen notably.

Nonetheless, the analytics show that majority of the listings from both periods before and after the Covid-19 lockdown are apartments and flats.

Hence, this shows that these two property types are the most in-demand properties as they are known to be substantially cheaper.

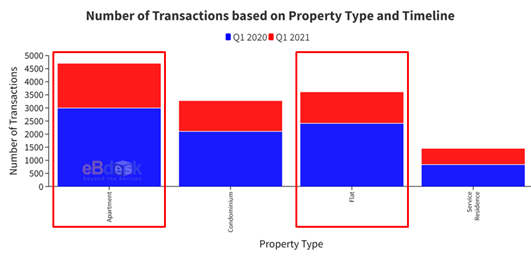

However, despite the significant decrease of number of listings in high-rise properties in 1Q2021, in terms of price distribution, it seems that there are barely notable differences.

From the analysis below, it was found that there was not much difference of high-rise property prices even after the pandemic had happened.

As shown, the price distribution between the various high-rise property types maintained even after the lockdowns which have impacted our country’s economy and strained people’s financial burden.

Thus, this shows that even though the number of high-rise properties listings were affected by the pandemic, the price barely gotten any significant impact.