High-Rise Value Amidst Covid-19

As COVID-19 rages around the country, these uncertain times can be felt equally across all economic sectors.

Due to reasons such as the Movement Control Order (MCO) and different SOPs established, Malaysians continue to be uncertain about property prices and endure delays in property transactions.

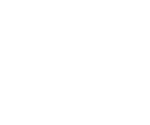

This could be further seen through the analysis of property transaction for high-rise between 1Q2020 and 1Q2021, in which the latter period has experienced a significant decreased of high-rise property transaction.

However, based on the analysis below from a prominent transaction property website, high-rise property that cost between RM 100K to RM 500K remained to be favourable among buyers in both timelines.

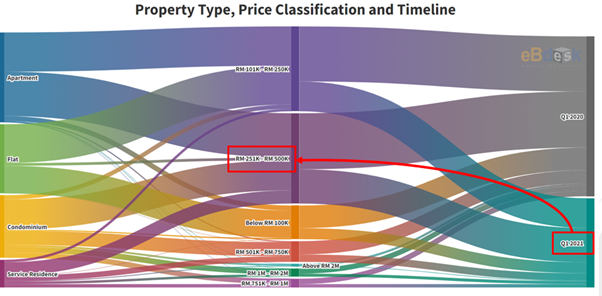

This indicates that the website is catering to a greater number of low and middle-income people. In contrast to cheap and mid-end houses, higher-end properties are less well-publicized.

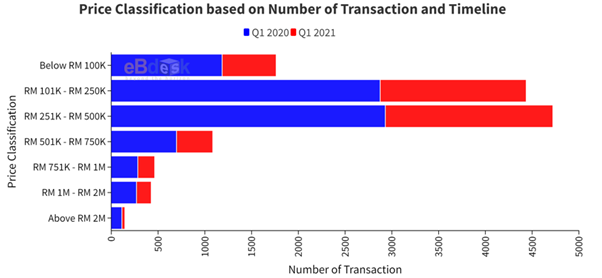

Although there are significantly fewer listings after the first Covid-19 lockdown, properties priced RM251,000 to RM500,000 are more prominent during 1Q2021, despite numerous reports of people experiencing financial difficulties.

Nonetheless, properties priced between RM100,000 and RM250,000 remain popular in both periods.

The leasehold category is primarily responsible for the increase in high-rise properties priced between RM251,000 and RM500,000 during the 1Q2021 period. Previously, properties costing RM101,000 to RM250,000 dominated the leasehold category.

As a result, more middle-tier properties are being advertised following the lockdown. Nonetheless, the number of luxury listings priced above RM1 million fell in 1Q2021.

While the Covid-19 pandemic has affected the people financially, the analysis shows that high-rise property priced between RM 251K to RM 500K has the most number of transaction in 1Q2021, indicating that some of the government’s incentives to help the property market might influence some of the buyers to buy property.