Bank Q2 net profit unveils the impact of loan moratorium

On March 25, Bank Negara announced that automatic moratorium on loan repayments was granted to SMEs and individuals to relieve the burden of Covid-19 pandemic on businesses and households. The moratorium is part of PRIHATIN stimulus package to arrest the economic impact of the pandemic.

Due to the moratorium, all debtors can delay their repayment for a period of 6 months. Based on the survey by the Department of Statistics, around 60.5% respondents have taken the loan moratorium initiative.

Since the moratorium stop the bank from collecting repayment from all debtors, it would affect the profitability of the bank at the level of interest incomes.

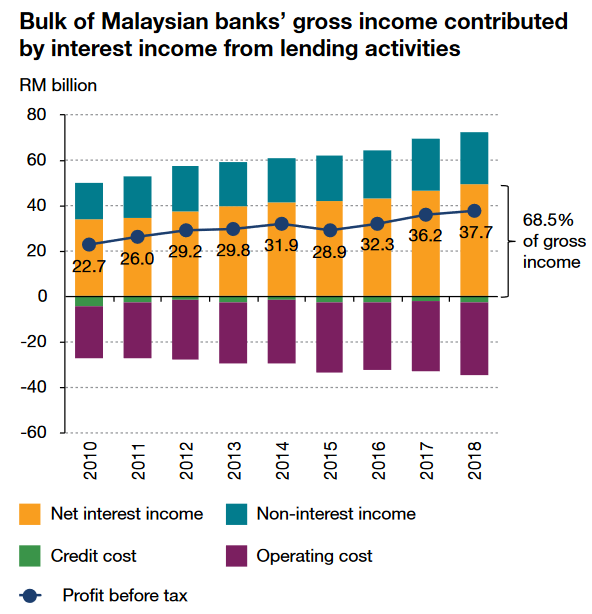

According to Bank Negara, 68.5% of gross income of all bank come from interest incomes.

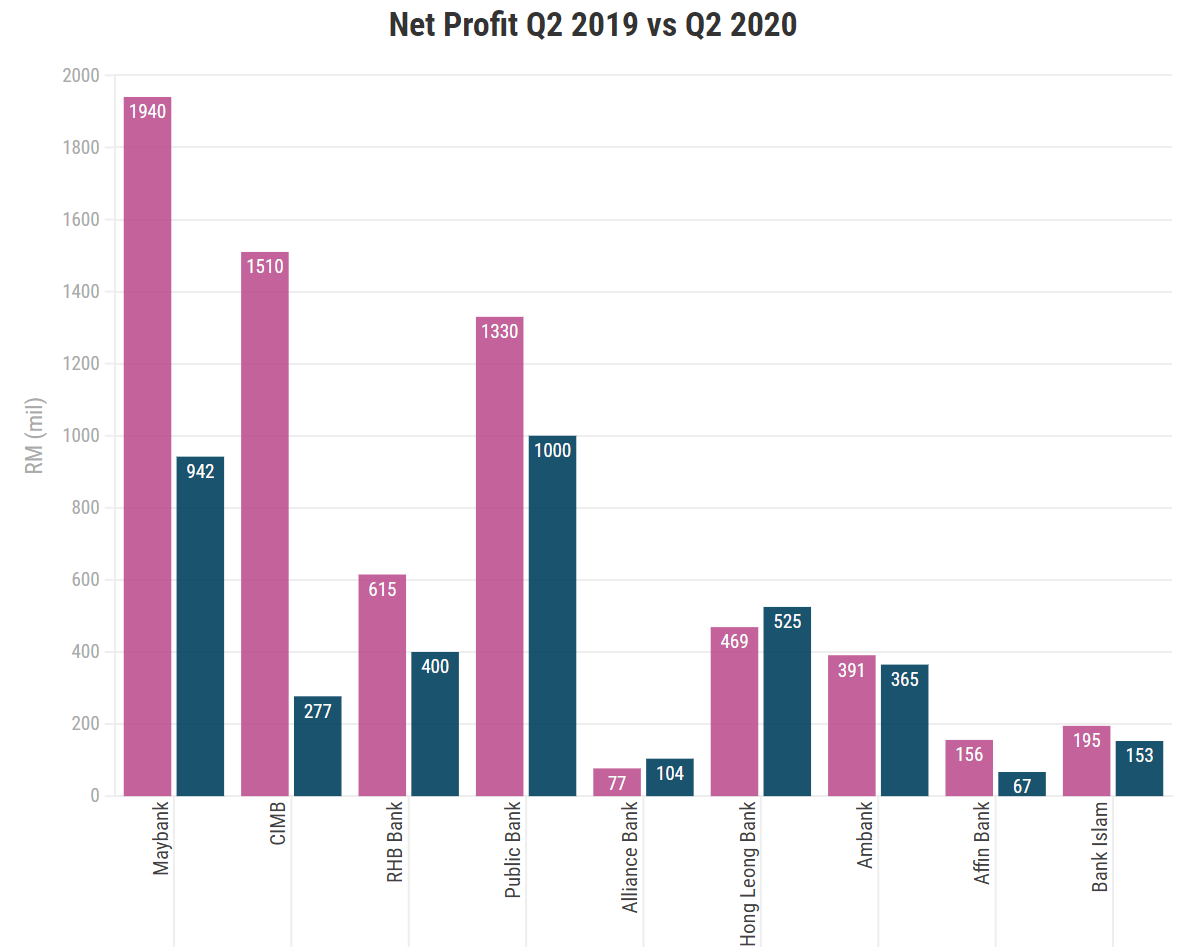

As the banking industry unveiled their net profit for the second quarter of 2020, the limited earnings due to loan losses, loan moratoriums and lower operating expenses saw a full-blown picture on the profitability of local banks. All of the 10 listed banks saw a quarter-on-quarter decline in net profit except Hong Leong Bank Bhd, AMMB Holdings Bhd and Alliance Bank Bhd.

All of the 10 listed banks saw a quarter-on-quarter decline in net profit except Hong Leong Bank Bhd, AMMB Holdings Bhd and Alliance Bank Bhd.

Maybank and CIMB both reported a staggering decline of 52.6% and 82% of net profit on 2Q 2020. Of the 10 listed banks, all saw a quarter-on-quarter decline in net profit, except for Hong Leong Bank Bhd and Alliance Bank Bhd.

As expected, most of the banks saw a sharp fall in earnings due to the higher loan loss provisions as well as the cut in net interest margin following the cuts in the Overnight Policy Rate (OPR). If Bank Negara announced another cut in OPR, it will greatly impact the banks’ net interest margin and consequently their earnings in the second half of 2020.